Canada Recovery Hiring Program (CRHP)

You can still get money to help you cope with the increasing costs of payroll. You do NOT need to be in the hardest-hit sectors or in the tourism and hospitality industry to be eligible for this wage subsidy.

The program ends on May 7, 2022, but it is retroactive, and applications are accepted up to 180 after the end of a period (Nov. 3 is the last day you can apply for the last period). So, the sooner you apply, the more money you can get!

How does CRHP work?

- Revenue loss needed: at least 10%

- Wages eligible:

- New hires

- Increased hours or wages of existing employees

- Retroactive applications: you can apply up to 180 days after the end of a claim period.

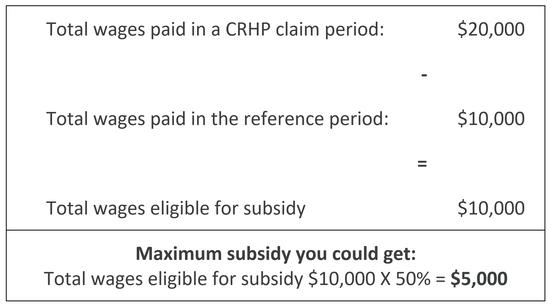

- Subsidy available: Up to 50% of the remuneration that exceeds the remuneration you paid during the reference period (March 14, 2021, to April 10, 2021).

Example:

In the example above, you could get up to $5,000. Your business could surely make good use of this kind of money!

| Periods | Period dates | Last day to claim CRHP |

|---|---|---|

| Period 22 | Oct 24 to Nov 20, 2021 | May 19, 2022 |

| Period 23 | Nov 21 to Dec 18, 2021 | June 16, 2022 |

| Period 24 | Dec 19, 2021, to Jan 15, 2022 | July 14, 2022 |

| Period 25 | Jan 16 to Feb 12, 2022 | August 11, 2022 |

| Period 26 | Feb 13 to Mar 12, 2022 | September 8, 2022 |

| Period 27 | Mar 13 to Apr 9, 2022 | October 6, 2022 |

| Period 28 | Apr 10 to May 7, 2022 | November 3, 2022 |

Don’t wait! See below for all the details to know if you qualify or talk to our advisors at 1-833-568-2342 if you need help or have questions.

What is the CRHP?

The Canada Recovery Hiring Program (CRHP) is a hiring subsidy which will support employers with a subsidy of up to 50% on incremental remuneration paid to eligible working employees (I.e., the portion of remuneration exceeding the remuneration of the baseline period). It will be offered until May 7, 2022, to qualifying employers who have seen a drop in revenue due to COVID-19. During the periods where applicants are eligible for the CEWS, they will have the choice of benefiting from either the CRHP or the CEWS with a declining rate.

Most recent update:

On December 17, 2021, Bill C-2 received Royal Assent, extending the Canada Recovery Hiring Program until May 7, 2022.

As more details are available, we’ll update our website with the most accurate, recent information.

CRHP Program Overview

How the program is administered: CRHP is administered by the Canada Revenue Agency (CRA) on a period-by-period basis, with each period spanning 4 weeks (this is referred to as a CRHP Claim Period). Below is a schedule of CRHP Claim Periods, but please keep in mind that this program will overlap with the declining CEWS. Applicants will be able to select the more beneficial between the two programs:

| Period 21 | Period 22 | Period 23 | Period 24 | Period 25 | Period 26 | Period 27 | Period 28 |

|---|---|---|---|---|---|---|---|

| Sep 26 to Oct 23, 2021 | Oct 24 to Nov 20, 2021 | Nov 21 to Dec 18, 2021 | Dec 19, 2021, to Jan 15, 2022 | Jan 16 to Feb 12, 2022 | Feb 13 to Mar 12, 2022 | Mar 13 to Apr 9, 2022 | Apr 10 to May 7, 2022 |

Amount businesses can receive: 50% (declining to 20% by the final period) multiplied by incremental payroll of active employee wages (not including furloughed employees) in comparison to the active employees’ wages between March 14 and April 10, 2021 (from CEWS period 14). There is no maximum dollar amount a business can receive from the program; however, there is a limit on the amount of subsidy you can receive for a single employee’s weekly wages.

Program duration: June 6, 2021, to May 7, 2022

How to apply: Applications are open through CRA’s My Business Account, Represent a Client, or the web application form.

Application deadline: 180 days after the end of the claim period.

Eligibility criteria: Nearly all businesses are eligible for the hiring subsidy. To be eligible, your business must:

- Have a CRA Business Number issued before March 15 or a third-party payroll provider who submits your payroll to CRA;

- Have active employees on payroll who receive a T4 slip (includes new hires); and

- Have a revenue loss of more than:

- 0% for CRHP period 17 (between June 6 and July 3, 2021).

- 10% for CRHP period 18 (July 4 – July 31) and all following CRHP periods.

Please see the eligibility requirements below for more details.

How to calculate: Each claim period you apply for has its own calculation. Please see the eligibility requirements below for more details. For a quick estimate of your CRHP you will need to determine your active employee payroll for the current period (current period remuneration) and subtract the active employee payroll paid between March 14 and April 10 (Base period remuneration). Then multiply the result by the CRHP subsidy rate for the claim period to determine the maximum CRHP amount ($) that your business is eligible for.

(Current period remuneration – Base period remuneration) (CRHP subsidy rate) = CRHP ($)

CRHP Eligibility Requirements

Determine if your business meets all four of the following criteria:

1. You had a CRA payroll account on or before March 15, 2020

Alternatively, you may still qualify if:

- Your business uses a third-party payroll provider; or

- you acquired assets (such as a business) during the qualifying period (or before that) that were:

- Of fair market value,

- Used by the seller in the course of a business in Canada, and

- Not purchased to increase your CRHP.

2. You are an eligible employer

You are an eligible employer if you are listed in any of the columns below:

Not exempt from income tax

|

Exempt from income tax:

|

Prescribed organizations:

|

You are an ineligible employer if you are a for-profit corporation that is not a CCPC, a cooperative ineligible for the small business deduction, or a partnership with 50% or less of its interest held by eligible employers.

3. You meet the revenue drop requirement during a CRHP Claim Period

You must have a revenue loss of more than:

- 0% for CRHP period 17 (between June 6 and July 3, 2021).

- 10% for any following CRHP period.

To calculate your revenue drop, you must:

- Determine your revenues for the applicable period(s)

- Calculate your revenue reduction by choosing one of the following options:

- General approach: compare your business eligible revenue for the claim period month in 2021 you are applying for, with your eligible business revenue for the same month in 2019; OR

- Alternative approach: compare your business eligible revenue for the claim period month in 2021 you are applying for, with your average eligible business revenue for the months of January and February 2020.

Note: if you choose the Alternative Approach, you will need to file an election. Please see the FAQ for more information.

| Period 17-28 | ||

|---|---|---|

| Revenue Drop calculation | GENERAL APPROACH Claim month or Prior month - Same month 2019 |

ALTERNATIVE APPROACH Claim month or Prior month - Avg of Jan and Feb 2020* |

| *Average of Jan and Feb 2020 can reflect operational days by equating to = 0.5 (Jan and Feb 2020 Revenues) X (60 / # days operational in Jan and Feb 2020) | ||

Important: The approach you use for the CRHP must be consistent with your approaches for your CEWS and CERS claims. Should you decide to change your approach at any time, you will need to amend previous applications to reflect the change. All CRHP claims must use the same approach.

4. You have eligible employees during any CRHP Claim Period

An eligible employee must be:

- employed in Canada

- an active employee by working for any part of a week during the claim period

The eligible employees described below can be included in your subsidy if they are/were:

- Hired after March 15, 2020:

- Arm’s-length: eligible if they are being paid within the CRHP claim period.

- Non-arm’s-length: not eligible to be included in the CRHP.

- Non-arm’s-length: eligible to be included in your subsidy claim if they have an average weekly wage (also known as Pre-crisis pay or Baseline Remuneration) within any of the Baseline Remuneration periods below:

| BASELINE REMUNERATION PERIODS |

|

|---|

If the employee meets the above eligibility requirements you will still need to know whether your employee is at arm’s length, as the subsidy is calculated differently for each situation. Please see the below FAQ for more details.

Frequently Asked Questions

What do the CEWS, CERS, CRHP declining subsidy rates look like from September 26, 2021, to May 7, 2022?

| Period 21 Sept 26 – Oct 23 |

Period* 22 Oct 24 – Nov 20 |

Periods 23-26 Nov 21, 2021 - March 12, 2022 |

Periods 27-28 March 13 – May 7, 2022 |

|

|---|---|---|---|---|

| CEWS | 20% | THRP: 75% HHBRP: 50% |

THRP: 75% HHBRP: 50% |

THRP: 37.5% HHBRP: 25% |

| CERS | 20% | THRP: 75% HHBRP: 50% |

THRP: 75% HHBRP: 50% |

THRP: 37.5% HHBRP: 25% |

| CRHP | 30% | 50% | 50% | 50% |

What are the differences between the CEWS and the CRHP?

| Differences between | CEWS | CRHP |

|---|---|---|

| Comparison periods |

|

|

| Eligible corporations |

|

|

| Eligible Employee Remuneration |

|

|

| Revenue drop | The revenue drop determines your CEWS rate. | The revenue drop is to determine if you qualify for CRHP. |

| Subsidy Rate | Sliding scale | Fixed |

| Top-up | Dependent on revenue drop | Not available |

| Potential Executive pay Clawback | Companies that are listed or traded on a stock exchange or other public market may get their subsidy clawed back for period 17 and onwards if the company’s top 5 executives’ compensation is higher in 2021 than 2019. This does not apply to private companies. | Not applicable |

Can I benefit from the CRHP and the CEWS during the same period?

No, applicants will have to determine which program will benefit them more. You will be able to alternate between the programs from period to period; however, you cannot benefit from both within the same period, and the revenue approach must be consistent. The CRA is working on a calculator to help you determine which subsidy will benefit your more.

Can independent contractor wages or employee dividends be used for the new CRHP?

No, unfortunately this has not changed; however, we continue to advocate that government expand access. Eligible remuneration needs to be recorded on a T4.

Can bonuses be included when calculating the CRHP?

Yes, yearly bonuses are included in eligible active remuneration. Question 17-5 of the Frequently Asked Questions provides detailed information regarding bonuses.

The type of pay that is considered eligible remuneration, and how the pay is determined for each week is the same for the CRHP as for the CEWS. More information can be found on the government site regarding determining employee pay (eligible remuneration).

How do I calculate my Baseline Remuneration (Pre-crisis pay) for the CRHP?

Note: baseline remuneration (pre-crisis) pay is only required for employees who are non-arm's length.

The baseline remuneration is the average wage paid from a selected period prior to COVID-19. As shown below.

| Pre- crisis (Baseline Remuneration) Periods |

|

To maximize your employee’s Baseline Remuneration, you will need to determine which baseline period gives your employee the greatest average wage. Although it adds work to your calculations, we do recommend that you use the best baseline remuneration period for each employee depending on the CRHP period. To do this:

- Total all the remuneration paid to the employee during the selected Baseline Remuneration period.

- Divide the total pay by the number of days in the selected baseline period, subtracting all days within any period of 7 or more consecutive days the employee was not paid for.

- Multiply the result by 7 to get the average weekly Baseline Remuneration.

These steps can be expressed using this equation.

What is the Deeming rule?

A business can elect to use their current OR prior month’s revenue to compare with the previous year to determine which would provide them with the highest amount of subsidy.

I have multiple affiliated and/or amalgamated businesses or entities. Can I apply for the CRHP for each one?

The CRHP is being processed at the payroll program (RP) account level, but an exception is being made for certain affiliated businesses or entities. Some affiliated and/or amalgamated businesses or entities will be able to consolidate or separate their revenues.

My business is new. Is there a prior referencing period alternative to Jan/Feb that I can use for the CRHP?

No, unfortunately there are no alternative prior referencing periods alternative to Jan/Feb.

If a corporation who is an eligible employer amalgamates or winds-up after March 15, can its successor claim or continue to claim CRHP on its behalf?

A business can elect to amalgamate with a predecessor as long as the main purpose of the amalgamation was not to cause the new corporation to qualify for the CRHP or increase their amount of the CRHP. This rule was backdated to April 11, 2020, and allows a business to use their amalgamated corporation to calculate a benchmark revenue for the revenue decline test.

Can a CRHP decision be appealed?

You may appeal CRHP decisions by filing an objection after having received your notice of determination.

How does the new CRHP affect employees at arm's length?

The definition for arm's length can be found on CRA's website.

Simply put, a person at arm's length does not have a blood, trust or controlling relationship with the business entity. Persons not at arm's length can be more simply viewed as family, significant others, partnerships, or businesses where one partner has controlling interest/voting shares.

For example, an owner's daughter works for a business. She would be a "related person" not at arm's length. Whether the daughter's salary could be subsidized would depend on how her pay and decision making is structured within the business.

- Arm's length - Should the daughter be paid a salary reflected on a T4 and T4Sum, the business entity could subsidize her wage like other employees.

- Not arm's length - Should the daughter not be considered an employee under CRA employer/employee rules, the business entity would not be able to subsidize her wage.

- Should the daughter be hired after March 15th and given a salary that can be reflected on a T4 and T4Sum her wage would not be eligible for the subsidy. This would seem like the controlling partnership/family is creating a wage to subsidize.

I made a mistake in my application. Can I fix or amend it?

Changes to previous hiring program claims can be made either though My Business Account or Represent a Client. If you applied using the web form application, you will need to call the CRA’s Business Enquiries Line at 1-800-959-5525.

The deadline to make adjustments to or increase the amount of your claim is 180 days after the end of the claim period. After the deadline you will be able to cancel or reduce the amount of your claim by calling the CRA’s Business Enquiries Line at 1-800-959-5525.

Should you have missed the 180-day deadline because of an administrative delay or misunderstanding with the CRA, please call the CRA Business enquiries line (1-800-959-5525) to get an exception within 30 days of the 180-day deadline. For more details look at CRA’s CEWS FAQ 26-01.

What are the 125.7 CRHP Program Rules Elections?

These elections are CRA’s way of confirming if you are calculating your CRHP revenues differently from the revenues that you regularly submit to CRA.

If in your CRHP application, you chose to change your revenues in one (or more) of the below ways please ensure to check “Yes.” correctly in your CRHP elections. If you have not made any changes to your revenue, then please select no in your CRHP elections.

| Elections | Simplified Election |

|---|---|

| a joint election, along with each other member of the group that prepares consolidated financial statements, under paragraph 125.7(4)(a) of the Income Tax Act (revenue determined on a non-consolidated basis for members of the employer's group) | Did you combine/separate your financial statements with other entities? |

| a joint election, along with each other member of the affiliated group, under paragraph 125.7(4)(b) of the Income Tax Act (revenue determined on a consolidated basis for the employer's group) | |

| an election under paragraph 125.7(4)(c) of the Income Tax Act (joint venture election) | Is the entity a joint venture (by 2+ parties) & has its own revenues that are being used separately from the other parties? |

| a joint election, along with each person or partnership with which the employer does not deal at arm's length and from whom the employer earns all or substantially all of its qualifying revenue under paragraph 125.7(4)(d) of the Income Tax Act (non-arm's length revenue) | Is the revenue received in majority (CRA says 90%), from a non-arm’s length source? |

| an election under paragraph 125.7(4)(e) (i) of the Income Tax Act (cash method) an election under paragraph 125.7(4)(e) (ii) of the Income Tax Act (accrual method) NEW |

Did you switch your accounting method?

|

| an election under subparagraph (b)(ii) of the definition "prior reference period" in subsection 125.7(1) of the Income Tax Act (prior reference period election) | Did you use the alternative approach (avg of Jan/Feb)? |

| an election under subparagraph (a)(ii) or (b)(ii) of the definition "qualifying revenue" in subsection 125.7(1) of the Income Tax Act (election by registered charity or not-for-profit to exclude government funding) | Are you a registered charity or non-for profit who decided to exclude government funding? |

| an election under paragraph 125.7 (1)(b) of the definition “baseline remuneration” of the Income Tax Act (baseline remuneration period election) NEW | Did you use a new baseline remuneration period?

|

| A joint election between eligible entity and the seller of an asset, an election under paragraph 125.7 (4.1) (e) of the Income Tax Act (Asset sales). NEW - accountant recommended. | If you acquired a business or part of a business during the qualifying period (or before that) and it was:

You can use the seller’s revenue attributable to the purchased assets in calculating your CRHP revenue Drop. |

Other CRHP Resources

- CFIB- Letter to Minister Freeland on Extending federal support programs for small businesses at current subsidy rate levels

- CRA - CRHP/CEWS Calculator- coming soon

- CRA - CRHP application guide – coming soon

- CRA - CEWS FAQ – may refer to CRHP details in the future

What is CFIB advocating for on CRHP?

What we have achieved:

- CFIB recommended in all its pre-budget meetings to introduce significant hiring incentives to help reunite employees and employers, as well as offset the cost of CPP/QPP increases.

What we're pushing for:

- For government to extend the CRHP beyond May 7, 2022.

How you can help:

- We’ve pushed the government to make some progress, but we're still fighting for better relief measures. Add your voice today.

Visit our COVID-19 Help Centre

Our primary concern at CFIB is making sure you have the support you need to get through this uncertain and challenging time. We provide you with expert advice and ensure that you have all of the latest information on government announcements and available support.