CFIB study shows Calgary businesses pay over 4 times more property tax than residents on same value of property

Calgary February 26, 2019 –The Canadian Federation of Independent Business (CFIB) has released its annual Property Tax Gap Report, which analyzes the tax treatment of residential and commercial properties by municipal governments across Alberta, including trend-lines over the past decade (2009-2018).

The report has a special focus on the 20 largest municipalities and defines the “property tax gap” as the differential between commercial and residential property tax mill rates.

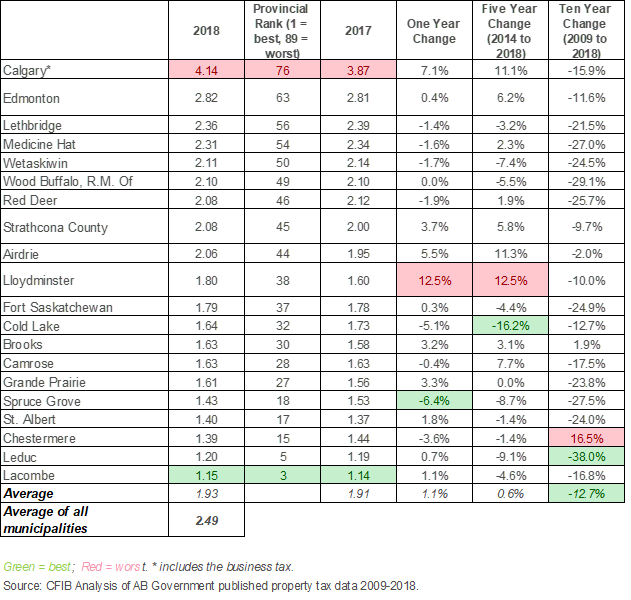

Out of the top 20, Calgary continues to have the biggest gap of any city in the province, now estimated to be 4.14. That means owners of commercial property pay more than 4 times more property tax than residential property owners, based on the same assessed value of property. Edmonton’s gap is second worst at 2.82 (see Figure 1 below for tax gaps of largest municipalities)

When broadening the scope to look Alberta’s largest municipalities (with populations greater than 5,000), the tax gap sit at 2.49. Findings indicate all municipalities have a lot of work to do to reach property tax fairness.

“Too many city governments continue to depend on squeezing more and more property taxes from local businesses to pay for their ever expanding operating budgets. This a risky and unfair strategy, as exposed by the recent situation in Calgary. In the midst of a struggling economy, assessed values for downtown commercial office space have plummeted, leaving small and medium-sized businesses outside the core expected to somehow pick up the tab. Talk about a tough pill to swallow,” says Richard Truscott, Vice-President, Alberta and BC.

Consultants working with the City of Calgary are holding roundtable sessions with local business owners today and Thursday to discuss short-term mitigation, as well as longer-term solutions.

To create a fair and balanced property tax system, CFIB recommends that municipalities:

- Introduce and implement a policy that reduces the commercial to residential tax gap over time to an absolute maximum ratio of 2:1

- Use restraint in municipal operating spending to help bring down the ratio

- Eliminate any additional business taxes

The full report containing data from all municipalities is available at www.cfib.ca

For more information or to arrange an interview, please contact Richard Truscott, Vice-President, Alberta and BC, at msalb@cfib.ca or 403-444-9290.