My business needs cost relief!

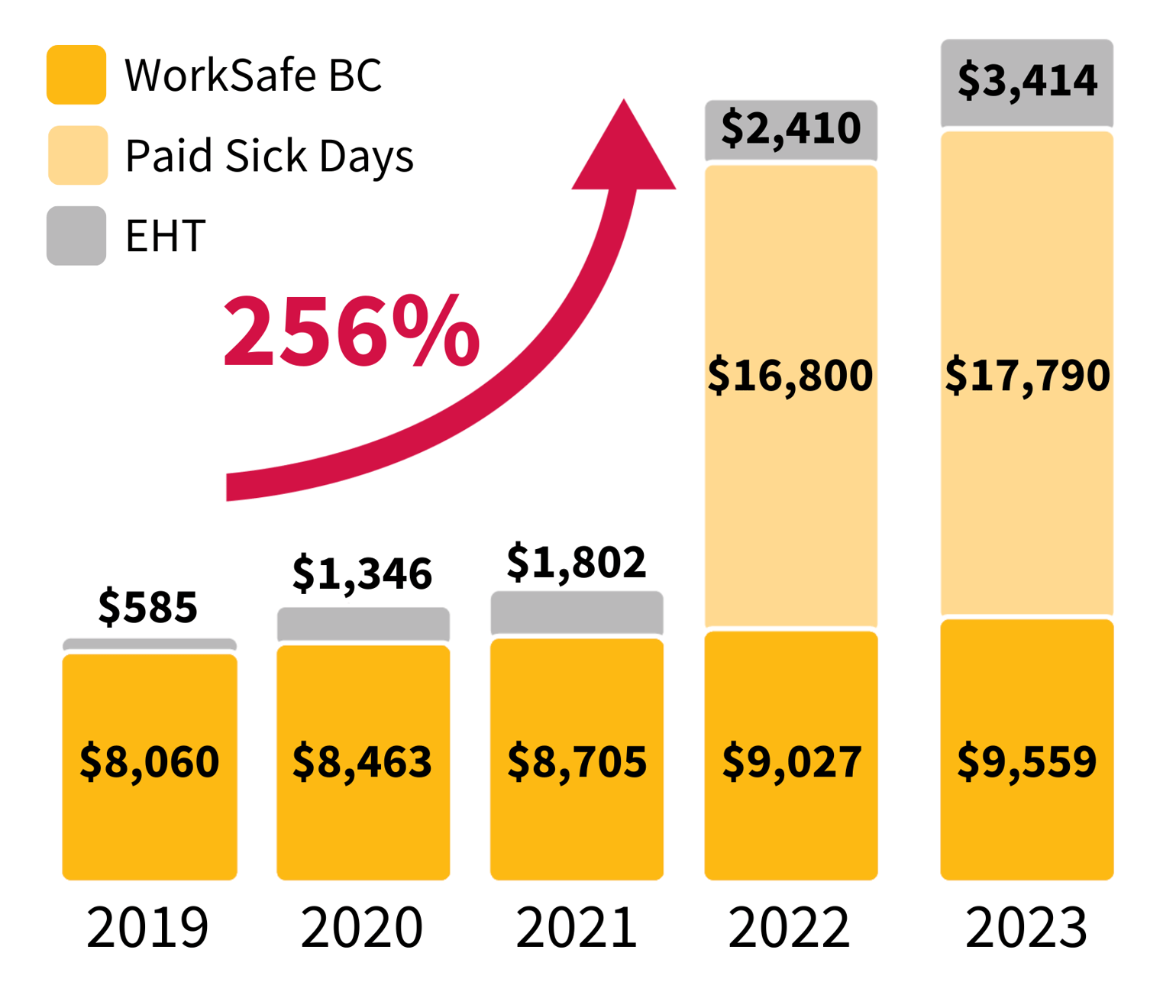

Payroll costs have increased by 256% in the last 5 years!

Provincial payroll costs for a BC business with 10 median wage workers1

1. CFIB’s own calculations based on Statistics Canada Table, BC government Employer Health Tax overview and WorkSafeBC 2023 premium rates

BC government fails at affordability for businesses2

| Grade | Affordability area |

|---|---|

| F | Addressing affordability challenges (i.e., for small businesses and the rest of the public) |

| F | Balancing the budget and paying down provincial debt |

| F | Prioritizing community safety |

| D | Addressing the rising cost of doing business |

| D | Reducing red tape |

2. Source: CFIB, BC Flash Survey - August, Preliminary results, August 29-Sept 7. n=366

Sign the petition

Dear Premier David Eby

CC: My Member of Parliament

My business is far from a full recovery. You have already increased the costs to my business. I need additional tax and cost relief to survive.

Here is what my business needs to recover:

- Do not increase the number of paid sick days and provide government support

- Increase the Employer Health Tax threshold to 1.5 million

- Refund WorkSafeBC’s $2.5 billion surplus

- Reduce the small businesses tax rate, increase the deduction threshold, and index this threshold to inflation

- Provide gas/energy cost relief (i.e. provincial fuel tax reduction)

- PST exemptions on input costs

- Revenue loss compensation for businesses impacted by construction projects

- Provide property tax relief (i.e. reduce the school tax)

The Canadian Federation of Independent Business (CFIB) is Canada’s largest association of small and medium-sized businesses with 100,000 members across every industry and region. CFIB is dedicated to increasing business owners’ chances of success by driving policy change at all levels of government, providing expert advice and tools, and negotiating exclusive savings.