My small business can’t afford another carbon tax!

The City of Vancouver has introduced a hidden carbon tax on commercial buildings.

In 2026, large office and retail buildings will be charged $350 per tonne carbon tax based on their emissions.

Some buildings will face up to $14,000 in extra taxes.

Businesses will pay the price through higher rents and fees!

Vancouver is the first jurisdiction to add an annual carbon tax to building operating permits, but it won’t be the last. Others may follow.

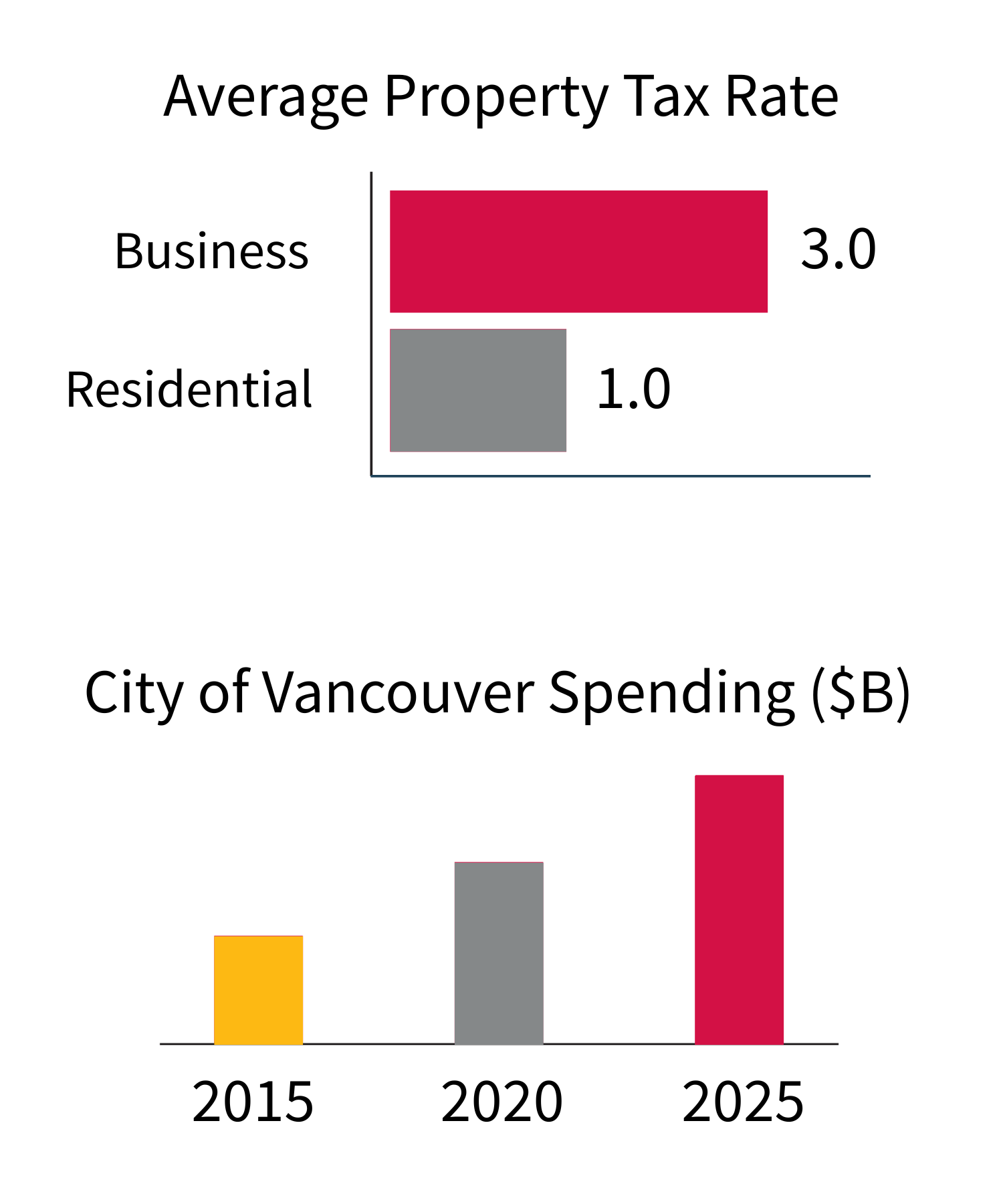

Businesses pay 3x more property tax than residents in BC’s 20 largest municipalities.

Municipal spending is out of control—the average local government is spending $1200 more per person per year compared to 25 years ago.

That’s a 91% increase in just 10 years — now they want you to foot the bill?

Sign the petition

Dear Mayor and Council,

Soaring inflation, trade disruption, and increasing property taxes are driving up costs for my small business like never before. I’m doing everything I can to stay afloat – but I need your support.

Instead of being overtaxed, that money should go towards growing my business, supporting my employees, and serving the community that keeps us going.

The cost of a municipal carbon tax on buildings will inevitably lead to higher rents, prices, or fees for my business, and when it does, it will seriously threaten my ability to keep my doors open in your city.

I need you to take action and say no to any municipal carbon tax. Not now, not ever.

The Canadian Federation of Independent Business (CFIB) is Canada’s largest association of small and medium-sized businesses with 100,000 members across every industry and region. CFIB is dedicated to increasing business owners’ chances of success by driving policy change at all levels of government, providing expert advice and tools, and negotiating exclusive savings.