Note: This blog was finalized on October 6; published on October 27. At finalization, author Beatrice Moen was an intern at CFIB. She is no longer with CFIB.

Canadian small- and medium-sized enterprises (SMEs) are the training ground for much of the country’s workforce. Representing 98% of all Canadian businesses and employing almost 8 million people (about 64% of employed individuals in the private sector), SMEs provide critical opportunities for individuals, particularly young workers and those with little prior work experience, to learn, develop skills, and gain valuable experience.1 For many Canadians, their first job is with a small business, making SMEs essential entry points into the labour market and key contributors to building the workforce of the future.

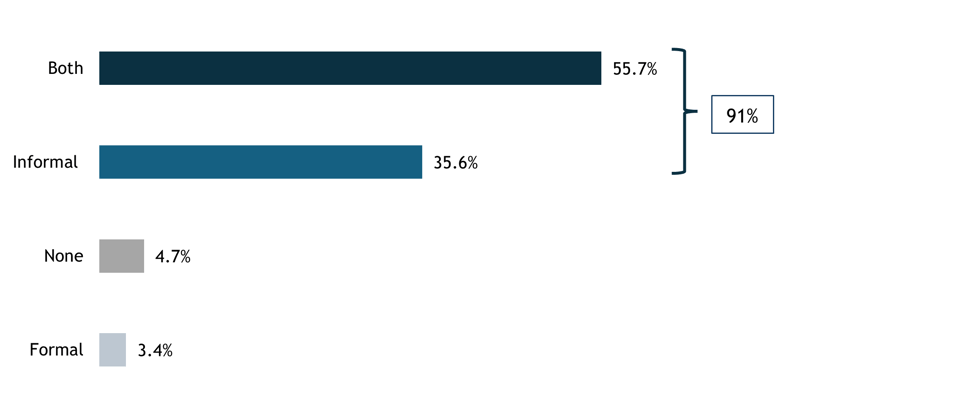

In the current context, hiring is slowing down and unemployment is on the rise. The Government of Canada has announced new investments in skills and workforce development, highlighting just how important training, and retraining, are to the Canadian economy.2 However, these initiatives emphasize formal training (obtaining qualifications through classes, workshops, or seminars), retraining, and sectoral strategies, when 91% of small business owners report the use of informal, on-the-job training in their business.3

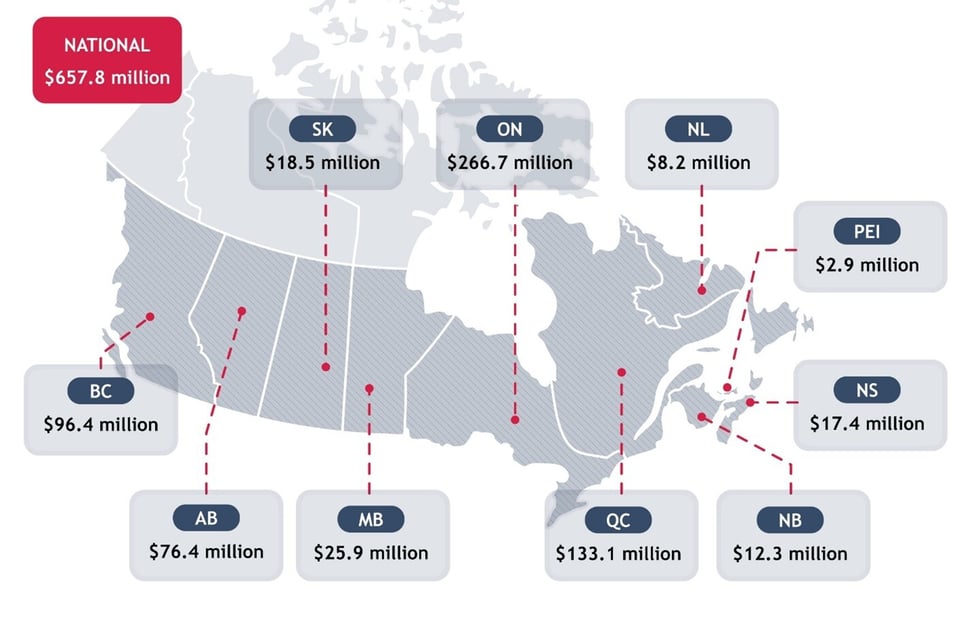

To shed light on SMEs’ investment in training, this blog draws on CFIB’s 2023 survey on training in SMEs. The data shows that half of small businesses across the country spend at least 40 hours each year providing informal training to a single new employee with no prior work experience, the rough equivalent of five full business days per year.4 This training occurs alongside the demands of daily operations, as well as onboarding experienced hires and upskilling existing staff. SMEs across Canada are investing roughly $657.8 million every year in informal training for new, inexperienced employees. Without explicit recognition of informal training, the true contribution of SMEs to Canada’s skills ecosystem remains undervalued, despite their central role in recruiting and skilling new workers.

Types of Training SMEs Offer

Canadian SMEs make use of both formal and informal approaches to support employee development. Formal training involves supporting employees in classes, workshops, and seminars that normally lead to a certificate or a diploma. Informal training refers to on-the-job learning that is typically provided by supervisors or co-workers to help employees update their skills, transfer knowledge within the firm, or onboard new staff. The choice of training method is based on many factors, including labour and skills shortages, economic conditions, industry needs, the cost of and availability of training, and the government support available.

Figure 1

9 in 10 SMEs provide informal training for their employees

Source: CFIB, Training in your business survey, October 2023, n=1,642.

Question: What type of training is provided for your employees? (Select one)

While only 3% of SMEs rely exclusively on formal training, over one-third (36%) rely exclusively on informal training. Overall, 91% of Canadian SMEs are providing informal training to their employees (Figure 1).

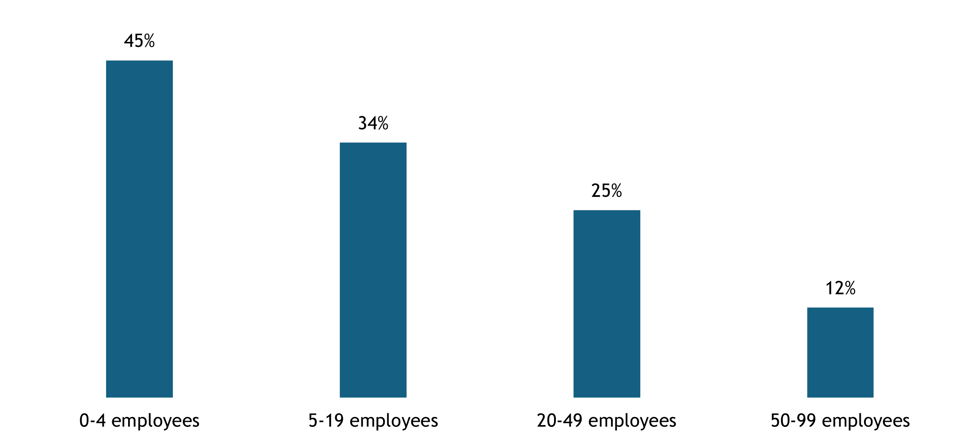

The exclusive reliance on informal training becomes increasingly apparent as the size of the business decreases (Figure 2). This trend reflects some of the unique dynamics and nature of small businesses, which tend to have flatter organizational structures where employees often fulfill multiple roles, interacting extensively with other employees and working in close contact with the business owner. These characteristics create better and more natural conditions for informal learning. As such, informal training is closely aligned with how small firms operate day-to-day, serving as the primary means to share knowledge and develop skills.

Figure 2

The smaller the business, the greater the reliance on informal training

Source: CFIB, Training in your business survey, October 2023, n=1,642.

Question: What type of training is provided for your employees? (Select one)

Value of SME Investment into Informal Training

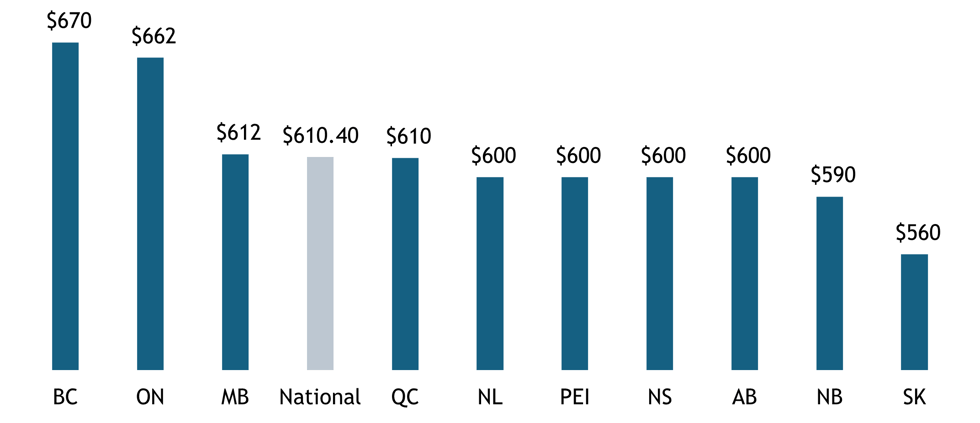

Across Canada, SMEs dedicate significant time and resources to training new employees with little or no prior work experience. Half of Canadian small businesses report spending at least 40 hours per year on informal training for each new hire with no prior work-related experience. The estimated cost of informal training for entry-level employees is $657.8 million annually (Figure 3, see the methodology section for more details). This means that SMEs in Canada invest approximately $610.40 per year into on-the-job training for one new employee with no professional experience (Figure 4).

Figure 3

Annual investments made by SMEs in informal training for inexperienced workers, by province

Figure 4

Annual investment in informal training per new employee without experience, by province

Sources:

- Minimum wage by province as of October 2023. Accessed on provincial websites.

- CFIB, Training in your business survey, October 2023, n=2,102. Survey question: How many hours are you spending per year on informal training for a new hire - with no previous work-related experience? (Select one)

- Authors’ own calculations

Canadian SMEs are proud to provide training to their employees. As the training ground for much of Canada’s workforce, small businesses play a vital role in helping young and entry-level workers learn how to navigate the workplace, develop essential skills, and gain the confidence needed to launch lasting careers. Training also helps business owners adjust to persistent labour and skills shortages, enhance productivity, and improve employee retention.

“A lot of time and energy goes into training tradespeople, most of this is done in the job. It is very difficult to find experienced tradespeople, so we are continually hiring inexperienced people and working hard to train them properly. This demands the time and energy of our skilled experienced tradespeople and really makes it difficult to be highly productive because the tradespeople who can work quickly and efficiently are tied up training people with little or no skills. This in turn cuts heavily into our profit margins. The age demographic of skilled tradespeople is startling. Most are nearing retirement age. Big gaps in the labour force. Can’t train them fast enough.”

– Construction, 0-4 employees, New Brunswick

Government skills and employment support programs – out of reach for SMEs

While both federal and provincial governments offer support for formal and informal training, in 2023, only 23% of small businesses had used a government-sponsored training and employment support program in the past three years.5 At the federal level, about $3 billion in funding flows through Labour Market Development Agreements (LMDAs) and Workforce Development Agreements (WDAs) each year to provincial and territorial governments, who design and deliver skills development and employment support programs.6 The programs that were most frequently referenced as having been used by SMEs include the Canada Summer Jobs Program and other wage subsidy programs, employer-sponsored training programs (e.g., Canada-Ontario Job Grant), and apprenticeship programs.

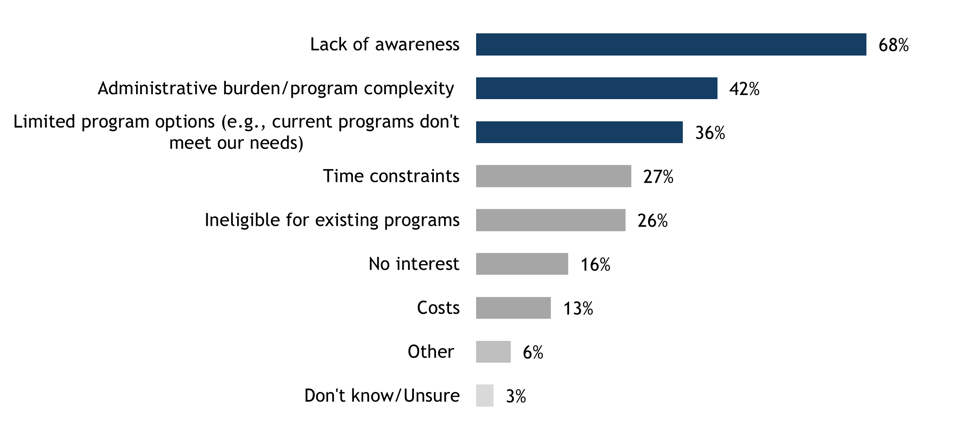

A lack of awareness is the principal driver (68%) of low take-up (Figure 5). For many small business owners, the first-time hearing about available government support for training was through CFIB’s survey.

“I did not know that there might be support for training. I am not even sure where to look!”

– Social Services, 5-19 employees, Ontario

“Was not aware of the government training programs. Where would one go to find what is available?”

– Wholesale, 5-19 employees, Ontario

Beyond awareness, other challenges impede SME participation: program complexity and paper burden (42%), misalignment with business needs (36%), time constraints (27%), and ineligibility (26%).

Figure 5

Factors preventing businesses from accessing government-sponsored training support

Sources: CFIB, Training in your business survey, October 2023, n=1,195.

Question: What factors prevent your business from accessing government-sponsored training support? (Select all that apply)

“We have found most programs are geared to big business.”

– Construction, 0-4 employees, ON

“All the government incentives only create paper burden and businesses have to conform their operations to enable funding or tax breaks from the government. Not an easy thing to do sometimes.”

– Manufacturing, 5-19 employees, AB

“We've used government sponsored training programs in the past - the paperwork was INSANE; the administrative burden made the program barely worth the effort .”

– Professional services, 5-19 employees, AB

While skills training and employment support funding is significant, their effectiveness depends on whether SMEs are meaningfully included and able to access these funds. Without addressing long-standing barriers, there is a risk that these new investments will bypass the very businesses that serve as Canada’s primary training ground for young and entry-level workers.

Recommendations

To address these challenges and unlock the full potential of SMEs in building Canada’s workforce, CFIB recommends the following actions:

- Strengthen small business engagement in Labour Market Transfer Agreements (LMTAs): Embed meaningful and ongoing consultation with SMEs in Labour Market Transfer Agreements to ensure training programs are aligned with employer needs. Without direct input, 87% of SMEs believe current EI-funded programs risk missing the mark.7

- Simplify access and raise awareness of existing supports and programs: Enhance outreach and reduce complexity in existing training programs to meet the needs and operational realities of SMEs. Nearly half (44%) of SMEs say that greater awareness and easier access to resources would encourage them to provide more training.8

- Provide simple, targeted financial incentives: Introduce simple, refundable tax-related credits that recognize both formal and informal training. Two in five (41%) small business owners say that targeted training tax credits would incentivize them to provide more training.7 A broad-based training tax credit, EI premium holidays, or other tax relief measures would free up resources for SMEs to invest in skills development.

- Reduce the overall tax burden: Nearly half (41%) of SMEs believe a lower tax load would enable them to redirect resources toward training, higher wages, and staff retention, strengthening competitiveness.7

SMEs are the foundation of Canada’s labour market and a critical training ground for new and inexperienced workers. Yet, their significant contributions to workforce development are often overlooked, and the costs of training – particularly informal training – remain a barrier to growth and retention. With youth unemployment sitting at 15%, helping small businesses hire, train, and retain young people without prior work experience is critical.9 Recognizing and supporting the value of informal training is not only an investment in small businesses but also in Canada’s long-term productivity, innovation, and economic growth.

METHODOLOGY AND DATA

This analysis combines survey data, wage figures, and employment statistics to estimate the value of informal training provided by Canadian SMEs. The steps and data sources are outlined below:

- Survey data (CFIB, 2023 – Training In Your Business survey):

- Collected member-reported feedback on the number of hours of informal training provided to new hires with little or no prior work-related experience.

- Data was analyzed at both the national and provincial levels.

- Wage data:

- Minimum wage rates as of October 2023 for each province were compiled.

- An average across provinces was calculated to establish a national average minimum wage.

- Calculation of training investment per hire:

- The median of annual informal training hours per new hire (40 hours) was multiplied by the minimum wage in each province to estimate the annual cost of informal training per entry-level employee.

- Employment data (Statistics Canada, July 2025)

- The number of employees aged 15–24 working in TEER 4 and 5 occupations (in all sectors excluding public administration) was collected at both the provincial and national levels. These classifications are part of the National Occupational Classification system, which categorizes jobs based on the training, education, experience, and responsibilities (TEER) they require.10

- TEER 4 and 5 classifications were selected because they typically represent jobs requiring little to no prior experience, making them the most relevant to assess informal training investments by SMEs.

- The 15–24 age group was selected as it represents workers most likely to enter the labour market with limited work-related experience.

- The total number of employees aged 15-24 working in TEER 4 and 5 occupations (excluding public administration) was multiplied by 63.6%, which represents the share of the private sector workforce employed in small- and medium-sized businesses.11

- Assumptions on informal training coverage in SMEs

- As 91% of Canadian SMEs report providing informal training in CFIB’s 2023 Training in Your Business survey, it was assumed that approximately 91% of employees aged 15–24 working in TEER 4 and 5 occupations in SMEs receive some level of informal training.

- This assumption is based on a proportional distribution of employees across SMEs, acknowledging that not all workers will receive the same intensity or type of training.

- This assumption was also applied at the provincial level, multiplying the share of SMEs that reported providing informal training by the number of employees aged 15-24 working in TEER 4 and 5 occupations in SMEs.

- Estimation of total annual cost of informal training

- The provincial per-hire cost of informal training was multiplied by the number of employees aged 15–24 working in TEER 4 and 5 occupations in small businesses that provide informal training.

- The resulting figure provides an estimate of the total annual cost of informal training for new hires with little or no experience at the provincial level.

- The national estimate was calculated as the sum of all provincial investments.

FOOT NOTES

1 Innovation, Science and Economic Development Canada, Key Small Business Statistics 2024, Table 4. Accessed: September 16, 2025.

2 Prime Minister’s Office, Prime Minister Carney launches new measures to protect, build, and transform Canadian strategic industries | Prime Minister of Canada. Released: September 5, 2025.

3 CFIB, Training in Your Business survey, October 2023, n=1,642. Survey question: What type of training is provided for your employees? (Select one)

4 40 hours is the median number of hours spent on informal training for a new hire with no prior work-related experience per year, based on survey responses from 2,102 small business owners. The average is 120 hours, equivalent to roughly 15 full business days per year.

5 CFIB, Training in Your Business survey, October 2023, n=1,552. Survey question: Have you used government-sponsored training support (e.g., training tax credits, wage subsidy, job-matching service, work integrated learning placements, etc.) during the past three years? (Select one answer only)

6 Employment and Social Development Canada, Labour Market Agreements. Accessed: September 16, 2025.

7CFIB, Special Employment Insurance Survey, January 28 – February 17, 2021, n=4,901

8CFIB, Training in Your Business survey, October 2023, n=1,628. Survey question: Which of the following would encourage your business to provide more training in general (formal and informal)? (Select a maximum of three responses)

9Statistics Canada, The Daily — Labour Force Survey, August 2025

10Statistics Canada, National Occupational Classification (NOC) 2021 for Analysis by TEER (Training, Education, Experience and Responsibility) categories - Background information. Accessed: September 16, 2025.

11 Innovation, Science and Economic Development Canada, Key Small Business Statistics 2024, Figure 8. Accessed: September 16, 2025.

Christina Santini, Laure-Anna Bomal and Beatrice Moen, "Canada’s Training Ground: How Small Businesses are Building Tomorrow’s Workforce", CFIB, InsightBiz blog, October 27, 2025, https://www.cfib-fcei.ca/en/research-economic-analysis/canadas-training-ground-how-small-businesses-are-building-tomorrows-workforce.

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Canadian Federation of Independent Business. Any errors or omissions are the responsibility of the author(s).