Productivity has been, including very recently, a hot topic in Canada.

Measured through labour (in GDP per hour worked), capital, material or even a combination of these, productivity is essentially a measure of how efficient we are at producing something relative to the resources we use. Being able to grow our economy by producing higher-value goods and services or by using less labour or energy, for example, will make us more productive overall as a country. It will in turn generate or free up assets that we can reallocate elsewhere in the form of better wages for workers, healthier profits for companies (including the smaller ones), and a higher standard of living for all Canadians.

While productivity is a crucial aspect of our economic lives, unfortunately it is not on a solid path at the moment in Canada. In fact, as seen in the chart below, our productivity growth has been weak for quite a while, when compared to most other developed countries.

On average between 1981 and 2022, annual labour productivity growth in Canada, Ontario or Quebec has been outpaced by that of most OECD countries

Source: Productivité et prospérité au Québec – Bilan 2023, Centre sur la productivité et la prospérité – Fondation Walter J. Somers, HEC Montréal, March 2024, [French only].

Note: * OECD19 = average of all jurisdictions displayed above, minus Canada, Ontario and Quebec.

As the Canada-US comparison in the following chart shows, this lack of productivity growth, or in other words our slow progress at producing more per hours worked, has had a very important impact on our standard of living, measured in real GDP per capita.

Standard of living in Canada is losing ground to the US, as illustrated by the growing gap in real GDP per capita (shown as an index with 2016 Q1 = 100)

Source: Statistics Canada, tables 36-10-0104-01 and 17-10-009-01; U.S. Bureau of Economic Analysis, Table 1.1.6. Real Gross Domestic Product, Chained Dollars

Note: Adapted from Stéfane Marion, Attract private investment: Canada's only way out, Special Report, National Bank of Canada, March 2024.

Our standard of living, once among the highest of advanced economies, is now below the OECD average after losing significant ground over several decades, not just relative to the United States, but also to several other developed countries like Sweden and Australia. This matters because it will eventually significantly impact – some say it has already impacted – our capacity to attract the best talent, to build top-notch infrastructure or to provide an adequate social safety net to Canadians.

The key to reversing this weak progression in our standard of living is to fix our productivity issue.

Canadian productivity could be increased by streamlining regulation, unlocking 205 million hours or 11 billion dollars currently wasted on red tape

One popular measure of productivity is labour productivity, measured in GDP per hour worked. Conventional ways to look at an improvement in labour productivity usually involve an increase in some type of investment: more equipment available to each worker, more experience or education per worker, or improved technology.

While increased investment is a perfectly valid (and necessary) solution to our lack of productivity, given the size of the problem and what is at stake, there is also value in looking in additional directions for solutions that would make work hours more productive. For example, what if workers and firms could free up more of their time and resources currently spent on unnecessary tasks and reallocate them to more productive ones? That would certainly raise productivity, even without any increased investment.

This is where the “magic” happens.

There is actually a way to free up a treasure of 205 million hours or 11 billion dollars locked inside the Canadian economy.

That treasure is currently tied up in the red tape that businesses face on an almost daily basis.

To better understand, let’s first define what is exactly red tape. As our former colleague and regulation expert Laura Jones explained:

Justified regulation serves a clear purpose, delivers reasonable benefits relative to its costs, and is administered efficiently and fairly. It includes government laws, regulations, rules, and policies that support an efficient and effective marketplace and that provide citizens and businesses with intellectual property protections and other protections that they need. Many government rules (and the administration that supports them) fall into this category.

Excessive regulation is the dark side of regulating—government rules and processes run amok. It refers to rules, policies, and poor government service that do little or nothing to serve the public interest, while creating financial costs and frustration for producers and consumers alike. Sometimes the excess is the government rule or regulation itself. Other times it is the way the government rules are administered. Often it is a combination of both.

The second part of this definition is the essence of red tape.

Since 2005, CFIB has pioneered research into estimating the cost of regulation, including red tape, from government (federal, provincial, municipal) on Canadian businesses of all sizes. The sixth and latest edition of our research report revealed that in 2020 small businesses estimated the burden of regulation could be reduced by 28 per cent without sacrificing the public interest. This suggests that red tape costs about $11 billion a year. In terms of time, eliminating red tape would free up 205 million hours, or the equivalent of 105,000 full time jobs. What CFIB said in 2020 remains true today: reducing red tape would have a positive impact on productivity, jobs, and wages.

This matters even more given that Canada’s lack of productivity is also often blamed on its small business sector. However, CFIB data points to a large flaw in our regulatory framework, which acts as a disproportionate drag on smaller firms (it is also one of the important reasons justifying a lower corporate income tax rate for SMEs, and we will come back to that in a future post). As can be shown in the chart below, the 2020 cost of regulation per employee for businesses with fewer than five employees (a group which represents half of all businesses in Canada) was $7,024, or over five times the $1,237 per employee cost for businesses with a hundred employees or more.

In 2020, the cost of regulation per employee for microbusinesses was over five times what it was for the largest businesses

Source: The CFIB Regulation and Paperburden survey was conducted online November 6 – December 9, 2020 and 4,603 small business owners from Canada answered the questions used to build the chart above. For comparison purposes, a probability sample with the same number of respondents would have a margin of error of +/- 1.4%, 19 times out of 20. More details about the source and methodology available in the report.

Note: Respondents could select more than one answer choice.

Our research also found that in 2020 businesses spent an average of 677 hours – 85 days – on regulation. Assuming that 28 per cent of that time is dealing with red tape, as outlined above, we can estimate that reducing red tape has, according to business owners, the potential to save on average up to 189 hours or 24 days to each business, each year.

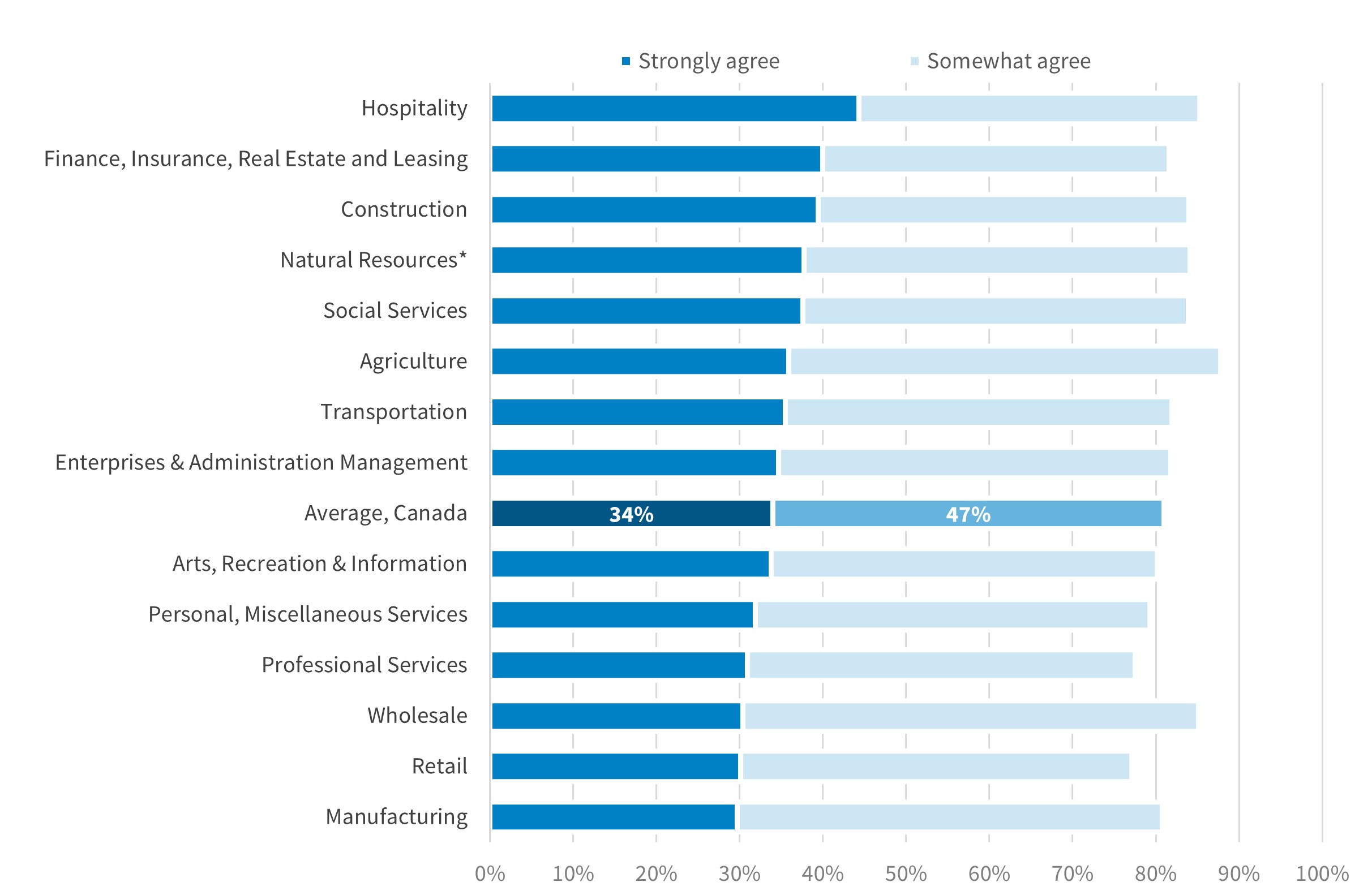

Given all of this, it is no wonder that a vast majority of SMEs agree (with a full third strongly agreeing) that red tape significantly impacts their productivity and slows them down.

“Excessive government regulations significantly reduce my business’s productivity and ability to grow”

Source: The CFIB Regulation and Paperburden survey was conducted online November 6 – December 9, 2020 and 4,978 small business owners from Canada answered the question above. For comparison purposes, a probability sample with the same number of respondents would have a margin of error of +/- 1.4%, 19 times out of 20.

Note: *Based on fewer than 40 responses.

Moreover, the same research has shown that if the costs of regulations were reduced, not only would more time could be allocated to sales, R&D or improving business operations, but a significant share of the money saved by businesses would actually be reinvested in measures that further boost productivity: 55% of small businesses would invest in equipment or expansion (the most popular option among our answer choices), and 30% would dedicate some of the money to increase employee training.

In the five decades that have passed since the foundation of CFIB, regulation and paper burden have consistently been among the top concerns of members. There are various ways in which governments can make red tape reduction a priority and free up more time and resources for hundreds of thousands of businesses, and CFIB has highlighted many of them over the years during its annual Red Tape Awareness WeekTM and on various other occasions. In a nutshell, the key aspects of red tape reduction are the following:

- the regulatory burden must be a political priority at the top levels of government;

- it needs to be measured;

- existing regulations must be carefully and regularly reviewed to assess their relevance and efficiency; and

- constraints on new regulations must be put in place to avoid making the overall burden constantly heavier.

Let’s hope this year and beyond, governments act on red tape reduction like never before, because our productivity and our standard of living could sure use a boost of 11 billion dollars, 205 million hours, or the equivalent of 105,000 full time jobs right about now.

Simon Gaudreault, "Canada's productivity: How to free up WAY more time and resources in our economy", CFIB, InsightBiz blog, April 4, 2024, https://www.cfib-fcei.ca/en/research-economic-analysis/canadas-productivity-how-to-free-up-way-more-time-and-resources-in-our-economy.

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Canadian Federation of Independent Business. Any errors or omissions are the responsibility of the author(s).