Executive summary

- This report aims to provide a broader perspective on Canadian business insolvencies (bankruptcies + proposals).

- Official small business bankruptcy numbers have been increasing steadily since the beginning of the year and are currently at a 2-year high. CFIB data shows these figures are just the tip of the iceberg.

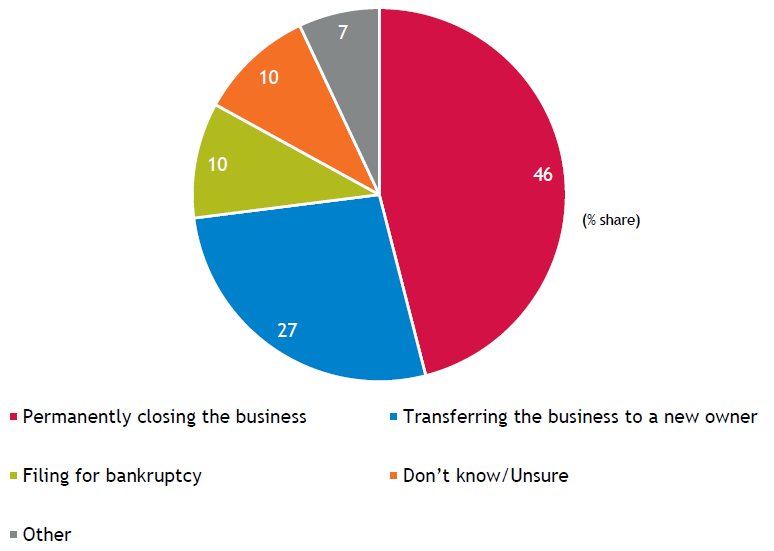

- According to recent exclusive CFIB data, only 10% of Canada’s small business owners would choose to file for bankruptcy if they were unable to keep their doors open. 46% of businesses at risk of closure would simply stop operating rather than go through the bankruptcy process. Canadian business insolvency data does not reflect these types of closures.

- As we emerge from the COVID-19 crisis, other challenges continue to deeply affect Canada’s small businesses, including struggles to return to normal revenues, the weight of the COVID-related debt businesses were forced to take on to pivot and survive, rising costs on virtually every business expense and a gripping shortage of labour.

- 54% of businesses are still reporting below-normal revenues and 62% are still carrying unpaid debt taken on during the pandemic, $158,000 on average, according to the latest available estimates.

- Small businesses are feeling the financial pressure mount and seem to have much less room to manoeuver. Targeted measures would keep many from closing for good.

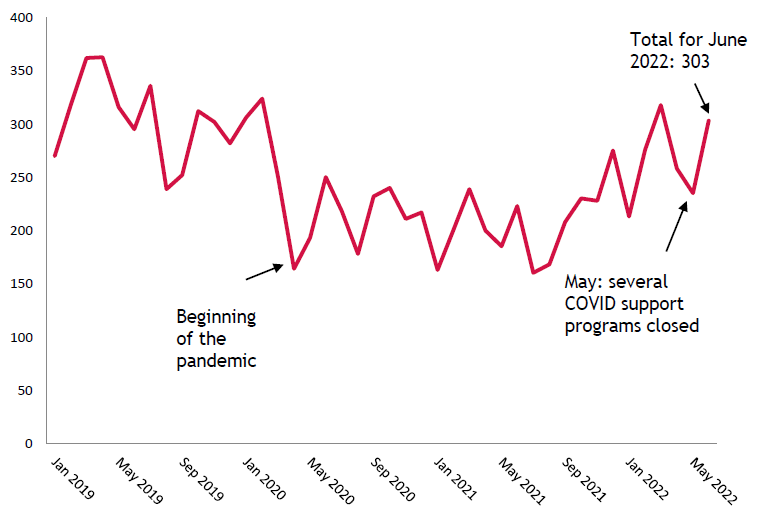

Business insolvency on the rise in Canada

Insolvencies in Canada may have declined early in the pandemic, but they have clearly been on an upward trend since mid-2021 (Figure 1).

Insolvencies since the start of the pandemic peaked in March 2022 with 318 cases. With the end of relief programs and businesses navigating a lot of uncertainty, the next few months will be critical for many small businesses.

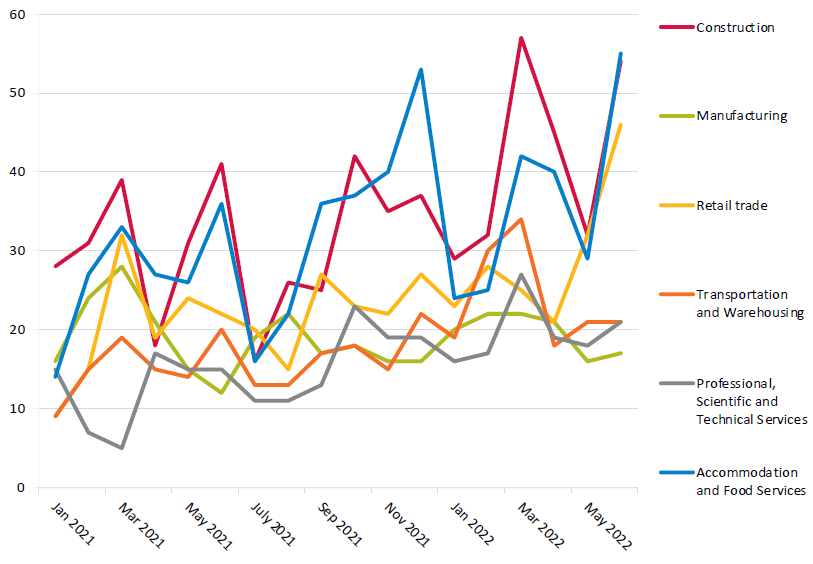

Insolvency numbers vary by sector

The construction and the accommodation and food services sectors have had the most insolvencies since the start of 2021. Figure 2 also shows an upward trend in other sectors during the same period.

Source: Insolvency and CCAA Statistics in Canada – Office of the Superintendent of Bankruptcy Canada (ic.gc.ca)

Note: We selected the 6 sectors with the most insolvencies.

Insolvencies: Only the tip of the iceberg

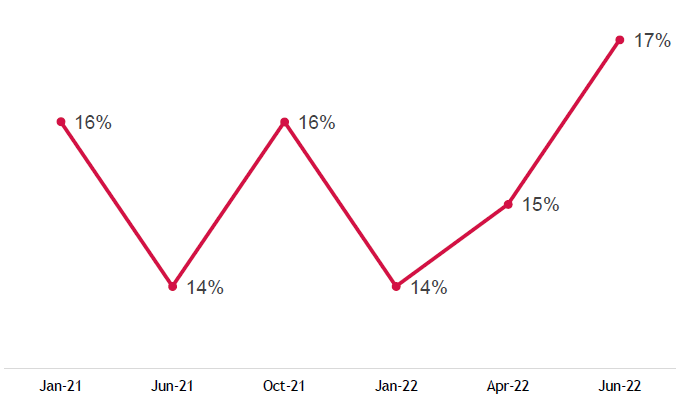

Since the pandemic began, a significant number of Canada’s small businesses reported their concern over the potential for bankruptcy or permanent closure.

Taking a look back at the January 2021 data in Figure 3, we can see that 16% of the country’s small businesses were already considering bankruptcy or closure. A year and a half later, the June 2022 CFIB survey shows things haven’t changed much, with more than one in six small businesses across the country considering going out of business.

The numbers seemed to be trending downward as 2022 kicked off, but that trend has reversed in recent months.

Source: CFIB, Your Voice surveys.

Note: The question asked was: “Please indicate the extent to which you agree or disagree with the following statement; ‘We are actively considering bankruptcy/winding down our business’ ”. The percentages represent the businesses that strongly agreed or somewhat agreed with the statement.

"Closed for good": the different paths

Bankruptcy is a major issue for Canadian small businesses in all sectors, but it does not measure the full scope of the problem. Of all the methods business owners would use to close their business due to financial hardship, filing for bankruptcy is only a small piece of the pie. In a recent CFIB study, only 10% of the businesses considering bankruptcy or closing would most likely do it by filing for bankruptcy.

Bankruptcy is not the first thing business owners think about when they can no longer keep their doors open. For nearly half of small business owners who think they will have to shut down in the near future, their first choice is to just wind down without going through the bankruptcy process.

Source: CFIB, Your Voice - June 2022 survey, June 9 - 30, n=368

Related Documents

| Release Date | Report | Download |

|---|---|---|

| August 2022 | Small Business Insolvency: The Tip of the Iceberg? |

PDF (737 KB) |

| August 2022 | Annex, provincial data, bankruptcy report |

PDF (221 KB) |

Share Article

Share Article

Print Article

Print Article