Summer 2025 Tourism Expectations

Key takeaways

- Tourism optimism remains among the lowest levels registered in the last 16 years.

- Very weak staffing plans, both full- and part-time.

- Tourism firms are even more concerned with the lack of demand than businesses in other industries.

Small business confidence among tourism businesses in Canada

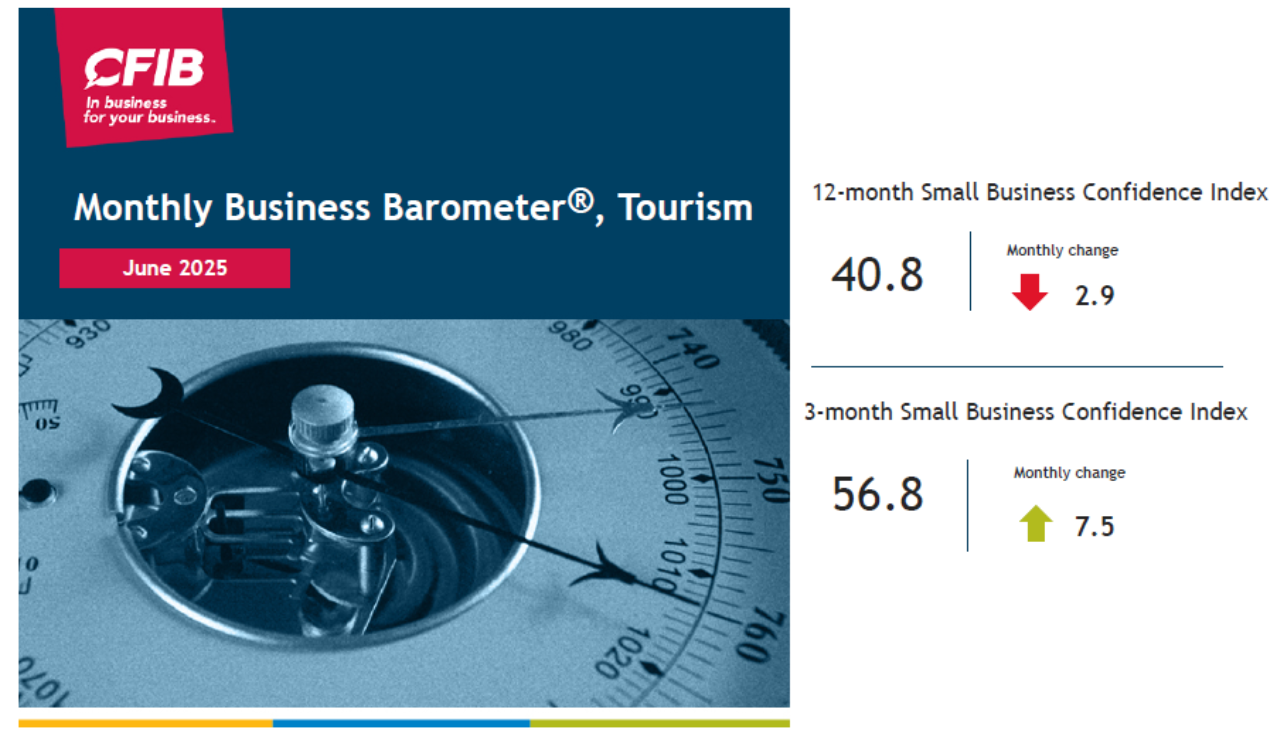

CFIB’s Business Barometer® long-term index for tourism, which is based on 12-month forward expectations for tourism business performance, sits at 40.8. The current level, among the lowest levels seen in the last 16 years, shows a rebound from March and April but it's still only at pandemic-era optimism.

The short-term optimism index for tourism businesses, based on a 3-month outlook, reached 56.8. Short-term confidence among these firms is highly seasonal and it is normal to see confidence increasing in Spring and decreasing in the late Fall months.

As with many sectors, short-term optimism in the tourism industry took the biggest hit during COVID, when business believed that the pandemic was a short-lived event and hoped things would turn around quickly. These past months, due to the U.S. tariffs threat, however, long-term optimism took the hardest hit and dropped to levels never seen before (17.6 index points in March).

Current state of business health

Only about 1 in 15 tourism businesses say they’re in good shape. That’s a long way from the pre-pandemic days when this number sat around 40%. During the worst of the pandemic, up to 70% said they were in poor health. Things aren’t as grim now, but the majority of tourism businesses aren’t thriving either.

Staffing intentions

Hiring intentions are very weak and that’s not normal for the industry. Historically, tourism hiring intentions have followed seasonal ups and downs; however, over the past 11 months we’ve seen negative full-time staffing plans.

Other indicators

While businesses across all industries are concerned about weak demand, tourism firms are even more concerned. Currently, 59% say demand is too low—the highest share recorded since October 2024. It’s the top limitation holding them back.

Wage costs are by far the main cost constraint for tourism firms. Fixed costs, such as insurance and occupancy costs, have surged since the pandemic, with no real sign of braking.

Methodology

This is a special release based on the responses received from tourism business who answered our June 'Your Business Outlook survey'. All indicators are calculated using the same methodology as for our regular monthly Business Barometer report.

About the index: Measured on a scale between 0 and 100, an index below 50 means owners expecting their business’s performance to be weaker over the next three or 12 months outnumber those expecting stronger performance.

About the sample: The definition of tourism businesses is derived from Statistics Canada's: Canadian Tourism Satellite Account Handbook. The following NAICS codes are included: 721, 722, 71, 48-49, 5321, 5615.

Andreea Bourgeois, Director of Economics

Simon Gaudreault, Vice-President, Research and Chief Economist

Laure-Anna Bomal, Economist

Related Documents

| Release Date | Report | Download |

|---|---|---|

| June 2025 | Tourism Business Barometer® |

PDF (1.2 MB) |

Share Article

Share Article

Print Article

Print Article