July 2025 Results

Key takeaways

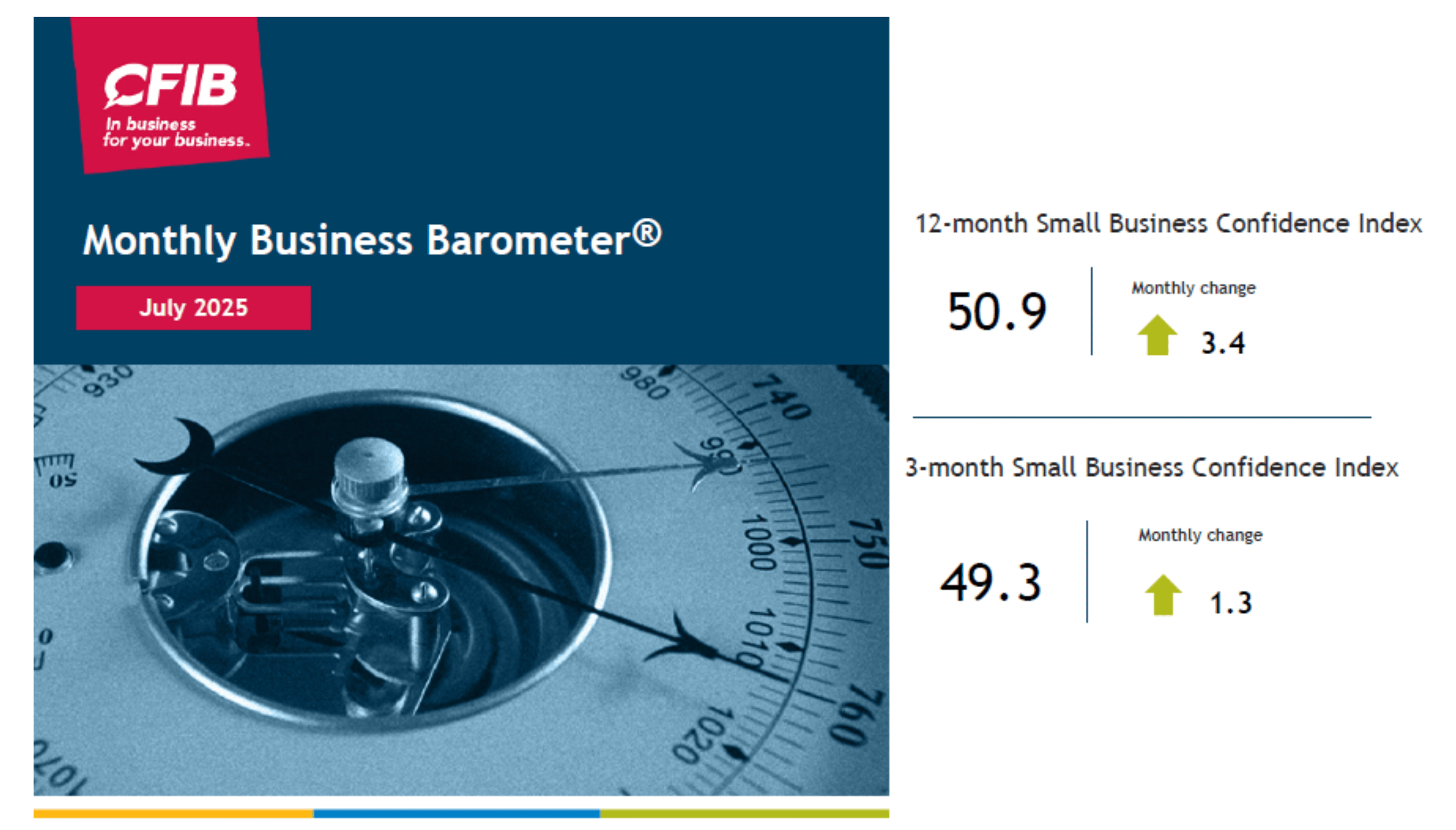

- Small business optimism increased again in July, shyly passing the breakeven point of 50;

- Insufficient demand remains the main limitation on growth;

- Average price increase planned for the next 12 months dropped to 2.7 from June's 2.9 level.

Small business optimism in Canada

CFIB’s Business Barometer® long-term index, which is based on 12-month forward expectations for business performance, inched forward by three points above the June level to reach 50.9. The short-term optimism index, based on a 3-month outlook, held steady at 49.3—just one point above its previous reading. Overall, small business confidence is edging up but it remains at the breakeven point where equal shares of business owners expect stronger and weaker performances.

While both exporting firms and importing firms gained in optimism, they are still lagging firms trading within Canada only.

Provincial picture

All provinces but one, British Columbia, gained momentum over the long- and short-term. However, long-term optimism among the four largest provinces is very timid, sitting around 55 in Alberta, and Quebec and around 48 in British Columbia, and Ontario.

Sectoral overview

Sectoral optimism remains uneven, ranging from a high of 55.6 in health and education to a low of 39.0 in agriculture and in finance, insurance, real estate and leasing. The broader industry picture points to an economy at a crossroads: six sectors posted optimism levels above the 50 mark, while the rest remain below it.

Inflation indicators

The average price increase planned for next 12 months dropped to 2.7 from the June’s 2.9 level. This is a positive change which shows inflation to be back to about January 2025 reading. The average wage increase hoovers around 2.1, and it has not been moving much over the past months. For more information on price and wage plans, the distribution of the average increase and comparison with past periods, click here.

Other indicators

The labour market remains weak – there are more employers looking to reduce staffing than to increase it. This continues the trend observed since the beginning of the year, with firms looking to hire being significantly under the historical trend while firms looking to lay off are more numerous than the historical average.

Insufficient demand remains elevated due to tariffs and counter-tariffs, and high uncertainty. Labour shortages are easing overall with employers having less appetite for hiring.

Methodology

These results are based on 719 responses received from July 3 to 8 from a stratified random sample of CFIB members to a controlled-access web survey. Findings are statistically accurate to +/- 3.7 per cent 19 times in 20. Every new month, the entire series of indicators is recalculated for the previous month to include all survey responses received in that previous month. Measured on a scale between 0 and 100, an index above 50 means owners expecting their business’s performance to be stronger over the next three or 12 months outnumber those expecting weaker performance.

The next Business Barometer will be released on August 21, 2025.

Here are the planned release dates for the remainder of 2025: August 21, September 18, October 16, November 20, December 18.

For regional information about business optimism, price plans, limitations and main cost constraints for SMEs, please visit: the Business Barometer, 2024 Retrospective.

We released a special edition on tourism businesses.

Andreea Bourgeois, Director of Economics

Simon Gaudreault, Vice-President, Research and Chief Economist

Laure-Anna Bomal, Economist

Related Documents

| Release Date | Report | Download |

|---|---|---|

| July 2025 | Business Barometer® National Summary |

PDF (1.6 MB) |

| July 2025 | Business Barometer® Provincial Summaries |

PDF (951 KB) |

| July 2025 | Business Barometer® Industry Summaries |

PDF (1.4 MB) |

| July 2025 | Business Barometer® Data Table |

Excel (366 KB) |

| July 2025 | Business Barometer® Price and Wage Plans |

PDF (800 KB) |

| January 2024 | Current Survey |

PDF (603 KB) |

| April 2020 | Survey - before 2024 |

PDF (84 KB) |

Share Article

Share Article

Print Article

Print Article