January 2026 Results

Key takeaways

- Small business optimism held steady in January, remaining close to its historical average of 60;

- Many small businesses are cautiously optimistic for 2026;

- About 40% of small businesses are affected by capital equipment and technology costs.

Small business optimism in Canada

CFIB’s Business Barometer® long-term index, which is based on 12-month forward expectations for business performance, reached 59.5—a slight decrease of 0.5 point from December. The short-term optimism index, based on a 3-month outlook, rose by 4.2 points to 52.4, indicating a small improvement .

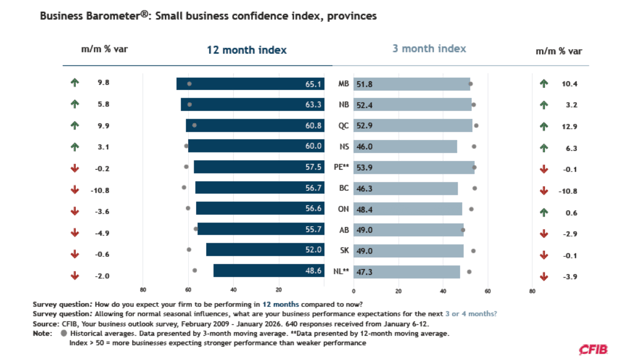

Provincial picture

The long-term confidence improved in Manitoba, New Brunswick, Quebec and Nova Scotia, all four posting index levels at or above 60. Short-term confidence remains noticeably lower in all provinces, ranging from the mid-40s to the mid-50s, pointing to ongoing economic uncertainty at the start 2026 .

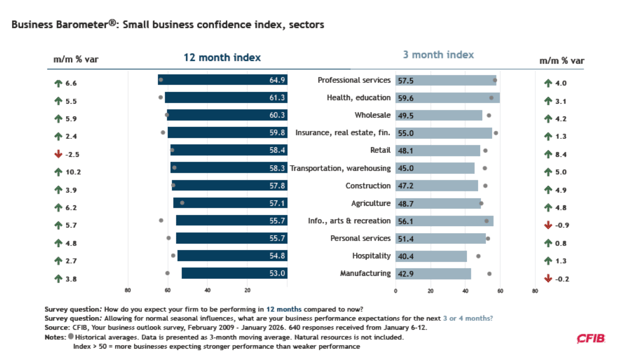

Sectoral overview

Long-term confidence was up in almost all sectors but retail. Professional services, health and education, and wholesale trade showed improving momentum, with confidence levels reaching 60 or higher.

For more information about retail sector's expectations, staffing and price plans, visit our new Retail dashboard.

State of business health

Business sentiment is moderately positive for the year ahead. Many businesses view 2026 as a year of improved conditions and growth, while others expect stability or continued challenges. Although uncertainty remains, it appears less prevalent than in 2025.

The current state of business health reached its historical average but has much potential for improvement for the economy to see steady growth.

Inflation indicators

The average price increase remained steady at 2.6% in January, while the average wage decreased slightly to 2.1%. For more information about price and wage plans, please see here.

Other indicators

Full-time staffing plans point to a modest employment uptick, with a larger share of employers planning to hire (15%) than to lay off staff (10%), illustrating a positive net balance for the first time since August 2025.

Insufficient demand remains the leading obstacle to business and production expansion, cited by 54% of SMEs—around 16 percentage points above its historical average. Cost‑related pressures continue to weigh heavily on growth prospects, led by tax and regulatory expenses (70%), wage costs (69%), and insurance costs (62%). Capital and technology costs are also rising steadily.

In business owners' words:

“At this time, we anticipate no major increases or decreases in our business—remaining relatively steady. Rising costs - especially for equipment - have also been a challenge. Earlier this year, we were forced to purchase a new printer sooner than planned to avoid an additional $7,000 due to tariffs.” Retail business owner, Alberta.

“2025 was a downturn for us but 2026 is looking like we will get back on track with a good amount of work already pre-sold.” Construction business owner, Ontario.

“As a small business the government overreach for taxes are horrendous. The added tariffs in our own country are impeding growth.” Retail business owner, New Brunswick.

“Overall, we have a positive forecast across the board. The one unknown factor of concern is the rollout of AI and how that will affect our clients’ needs and our operational processes.” Professional services business, Quebec.

Methodology

These results are based on 640 responses received from January 6 to 12 from a stratified random sample of CFIB members to a controlled-access web survey. Findings are statistically accurate to +/- 3.9 per cent 19 times in 20. Every new month, the entire series of indicators is recalculated for the previous month to include all survey responses received in that previous month. Measured on a scale between 0 and 100, an index above 50 means owners expecting their business’s performance to be stronger over the next three or 12 months outnumber those expecting weaker performance.

Release dates for 2026

January 22

February 19 - changed for February 26

March 19

April 16

May 21

June 18

July 23

August 20

September 17

October 22

November 19

December 17

For more information about the retail sector, see the dashboard below. It presents long and short term optimism, current state of business health, staffing plans, price and wage plans, as well as main costs and limitations for retail firms.

NEW

Regional data about business optimism, price plans, limitations and cost constraints:

the Business Barometer, 2025 Retrospective.

Related Documents

| Release Date | Report | Download |

|---|---|---|

| January 2026 | Business Barometer® National Summary |

PDF (3.5 MB) |

| January 2026 | Business Barometer® Provincial Summaries |

PDF (1.0 MB) |

| January 2026 | Business Barometer® Industry Summaries |

PDF (1.0 MB) |

| January 2026 | Business Barometer® Data Table |

Excel (600 KB) |

| January 2026 | Business Barometer® Price and Wage Plans |

PDF (800 KB) |

| January 2024 | Current Survey |

PDF (603 KB) |

| April 2020 | Survey - before 2024 |

PDF (84 KB) |

Share Article

Share Article

Print Article

Print Article