Make Your Voice Heard

CFIB: Amplifying the voices of small business since 1971.

Make Your Voice Heard

Over ---- important causes championed in support of small business success.

Millions of small businesses have been positively impacted by our advocacy work.

More than ---- signatures received in support of fair treatment for small businesses.

Our Advocacy Efforts

The Canadian Federation of Independent Business (CFIB) has been Canada's champion of small business for over 50 years.

Today, with more than 100,000 members located in communities across the country, we are Canada’s largest non-profit organization devoted to creating and supporting an environment where small businesses can thrive.

We advocate for small business with politicians and decision-makers at all three levels of government (municipal, provincial, and federal). As a non-partisan organization, we influence public policy based on our members’ views, ensuring that you have a chance to affect the laws and policies that affect your business.

Our Wins

2025

Carbon Tax Rebates

Thanks to CFIB’s relentless advocacy, the federal government returned $2.5B in carbon tax rebates to 600,000+ small businesses in 2024. An additional $600M will follow by year-end, and both 2024 and 2025 rebates are now tax-free—a historic win for small businesses.

2025

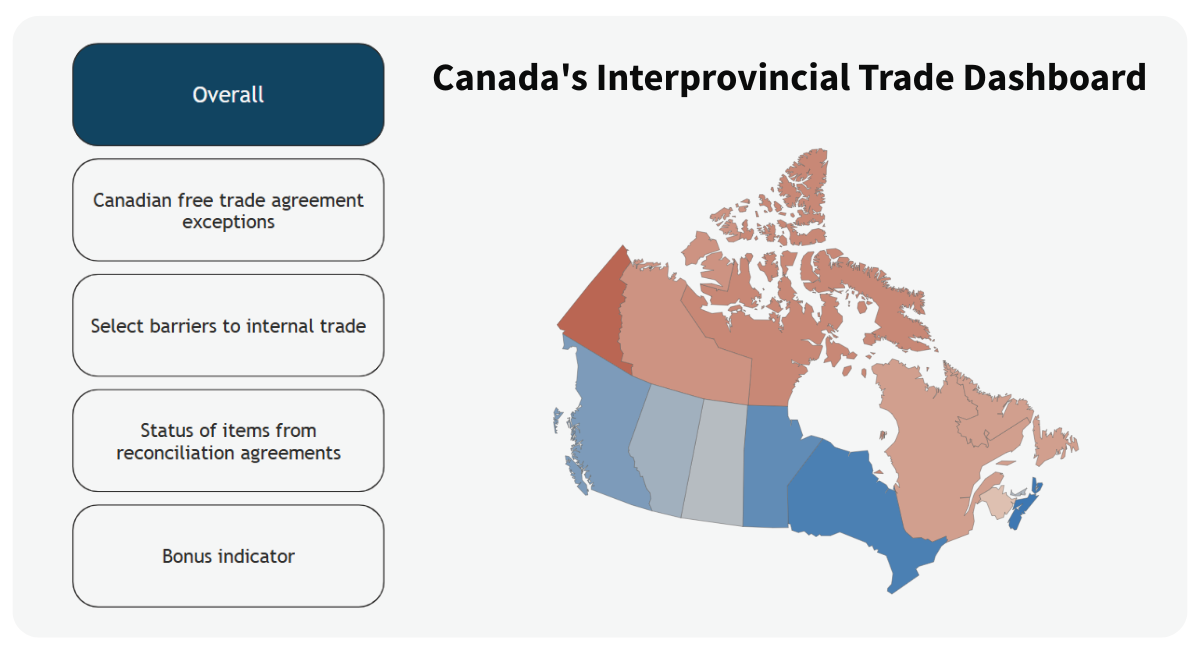

Internal Trade Reform

For years, CFIB has been fighting for Canada to embrace free trade and eliminate internal trade barriers. On November 19th, all provincial and territorial governments and the federal government announced a nationwide mutual recognition of non-food/beverage goods, meaning an item that meets standards in one province is compliant in all others.

2025

LGCE Increase

After significant CFIB pressure, Budget 2025 finally delivered on the federal government’s promise to increase the Lifetime Capital Gains Exemption (LGCE) threshold to $1.25 million. Going forward, the threshold will increase by inflation every year.

2023

Credit Card Processing Fees

After 15 years of CFIB advocacy, the federal government, joined by CFIB, announced an agreement between Visa, Mastercard, and the federal government for lower credit card fees for small business.

2021

Intergenerational Transfers

On June 29, Bill C-208 amended the Income Tax Act (ITA) to allow families to transfer shares of their small business, family farm, and/or fishing corporation to their children or grandchildren and be treated equally to those who were passing on their businesses to an unrelated corporation.

These new rules allow the “selling party” to pass on their company shares and absorb capital gains by using the Lifetime Capital Gains Exemption (LCGE).

2020

Pandemic Supports

During the COVID-19 Pandemic, CFIB's lobbying efforts were integral in the establishment of federal economic relief measures for small- and medium-sized enterprises (SMEs) such as the Canada Emergency Wage Subsidy (CEWS), the Canada Emergency Business Account (CEBA) eligibility for Small and Medium Enterprises (SMEs), and the Canada Emergency Rent Subsidy (CERS).

2017

Internal Trade

The Canadian Free Trade Agreement (CFTA) was signed on July 1st, by all provinces, territories and the federal government. Replacing the dated and ineffective Agreement on Internal Trade, the purpose of this new agreement is to reduce and eliminate barriers to the free movement of people, goods, services and investments within the country.

CFIB is holding governments to account to ensure progress continues.

Join over 100, 000 small business owners across the country.

The Canadian Federation of Independent Business (CFIB) is in every province and territory, from coast to coast. We advocate on behalf of independent Canadian business owners and fight for fairer taxes, laws and regulations to help promote their success. We believe that a stronger small business sector means a stronger Canada.

Our Current Initiatives

National Unfinished Business Petition

Calling on the federal government to lower the cost of doing business in Canada

Alberta Construction Petition

Calling on the provincial government to introduce construction mitigation policies

Alberta Municipal Tax Relief Petition

Calling on all Alberta municipalities to reduce property taxes for businesses

Alberta Tax Relief Petition

Calling on the Alberta government to offset the increased costs of doing business

British Columbia Cost Relief Petition

Calling on the provincial government to introduce cost relief measures for small businesses

British Columbia Employer-Paid Sick Days Petition

Calling on the BC government to avoid increasing the number of employer-paid sick days from 5 to 10

British Columbia Municipal Carbon Tax Petition

Calling on B.C. city councils to say no to a municipal carbon tax

Manitoba Affordability Petition

Calling on the provincial government to make Manitoba more affordable for small businesses

Manitoba Employer-Paid Sick Days Petition

Calling on the provincial government to say no to introducing paid sick days

New Brunswick Property Tax Petition

Calling on the provincial government to make the property tax fairer

Nova Scotia Property Tax Petition

Calling on the provincial government to reduce the property tax gap

Ontario Construction Petition

Calling on the provincial government to introduce construction mitigation policies

Ontario SBTR Petition

Calling on the Ontario government to lower the small business tax rate and increase the threshold

Prince Edward Island Electricity Rates Petition

Calling on the provincial government to make electricity rates fair for SMEs

Prince Edward Island Property Tax Petition

Calling on the provincial government to end the property tax gap for SMEs

Quebec Red Tape Petition

Calling on the provincial government to reduce the administrative burden on small businesses

Saskatchewan Affordability Petition

Calling on the provincial government to make Saskatchewan more affordable for small businesses